Is Now a Good Time To Sell Or Buy A Business?

How will the 2025 economy and interest rates affect small businesses and the M&A market? 2024 Small Business Acquisitions Up over 2023! Updated March 8th 2025 BizBuySell 2024 Q4 Market…

Learn MoreFiltered by: sba financing

How will the 2025 economy and interest rates affect small businesses and the M&A market? 2024 Small Business Acquisitions Up over 2023! Updated March 8th 2025 BizBuySell 2024 Q4 Market…

Learn More

Change is the heartbeat of progress, and even the SBA makes progress. Effective August 1st, 2023, the SBA updated its SOP with new rules simplifying SBA 7a business acquisition loans…

Learn More

A common question business owners have for business brokers is whether seller financing (carrying a seller note) the only option for selling a small to mid-sized business. The answer is…

Learn More

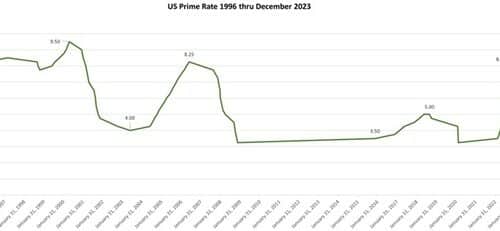

June 2024 UpdateUS Prime Rate still holding steady at 8.5% after June 2024 Fed meeting The Fed Rate remains unchanged after the June 2024 meeting, which left the US Prime…

Learn More

SBA financing is a win-win for business buyers and sellers. Getting an SBA Loan to buy or finance the sale of a business is a great way for buyers to…

Learn More

Great news for business owners-sellers and business buyers in 2021! 6 Months No Payments on New SBA Loans from February thru September 2021 plus PPP Loan Program 2021! The COVID Relief…

Learn More

Financing is a critical and frequently overlooked aspect of selling your business. The fact is all cash transactions are very rare other than for very small businesses. Nearly all business…

Learn More

With interest rates rising recently business buyers and sellers may wonder, “Will increased interest rates affect the value of a business being sold?” Spoiler... small changes in interest rates do…

Learn More

SBA loans can be used for financing a business acquisition of up to $5 million, as well as purchasing commercial real estate, machinery/equipment, refinancing debt, or obtaining working capital for…

Learn More| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |