With interest rates rising recently business buyers and sellers may wonder, “Will increased interest rates affect the value of a business being sold?” Spoiler… small changes in interest rates do not dramatically affect the value of a business or the net after debt service. In fact, a 0.25% interest rate increase only increases the annual debt service by roughly $3,000 per year on a $1 million transaction.

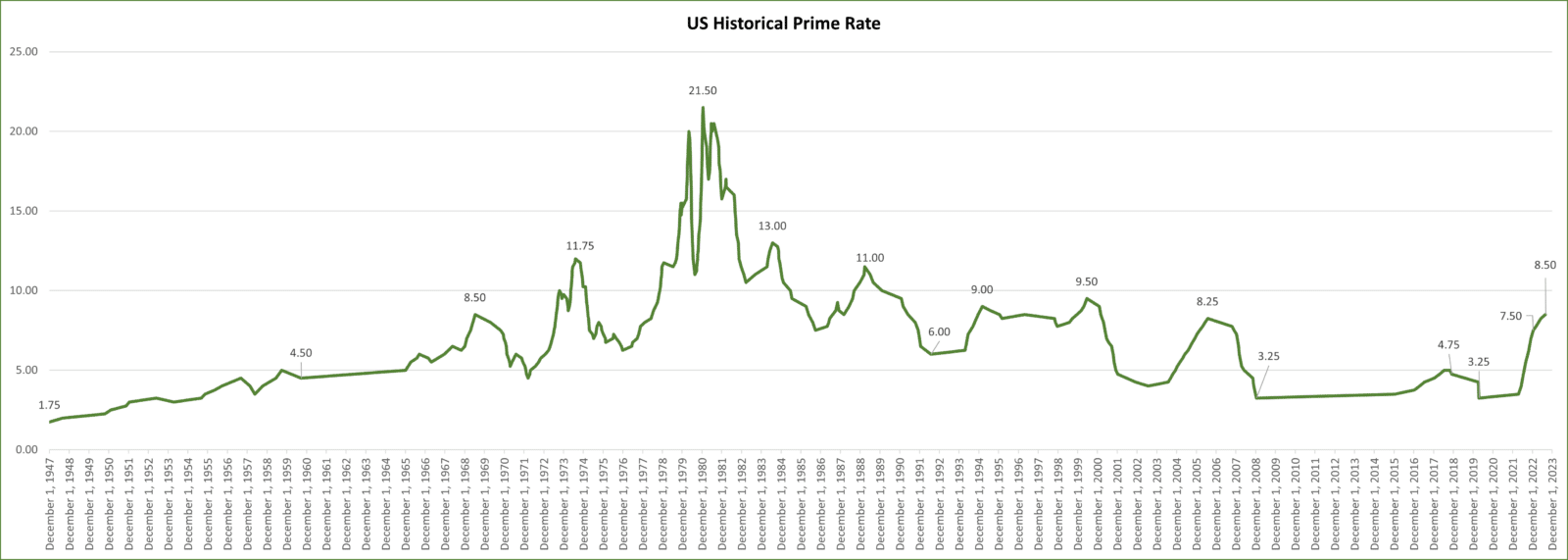

While rates have risen from a recent low of 3.25% in 2008 to 8.5% in effective July 2023 and holding as of April 2024, these are higher than recent rates, but not all-time highs. The all time high Prime Rate was a whopping 21.5% in December 1980 and the all-time low rate was 1.75% in 1947, in May of 2000 the rate was 9.5% and it was generally between 4% and 8% throughout the 2000’s, until it was dropped after the recession and again after the COVID Pandemic.

The Prime rate has increased to 8.5% and driven up the maximum allowable SBA 7a loan to 11.5%. While 11.5% is the maximum SBA 7a loan rate as of June 2024, few banks are charging this because the SBA business acquisition lending market remains very competitive. In fact, we have one lender who offers SBA 7a loans at 7.6%, 10 years fixed, as of June 2024, which is below the current Prime Rate.

In theory, as the cost of capital increases the value of a business or income property (such as commercial real estate and investment properties) will decrease. This is because the increased debt service expense reduces the net income and therefore reduces the amount a buyer would pay for the business or property.

The economic theory behind this is sound, and this tends to be the case with investment properties, but it does not always hold absolutely true. In the Orange County and Los Angeles commercial real estate markets prices have continued to increase steadily in spite of recent interest rate hikes. Likewise, business values have not been affected by recent increases in the prime rate and SBA loan rates. So why is this?

Business value multiples have generally stayed the same as interest rates have gone up and down. Business values are driven more by earnings than by the cost of capital. In fact, the cost of capital is a minor factor in most business acquisitions as long is interest rates are in historically normal ranges. The ultra-low rates after the recession of 2007/2008 and the COVID pandemic in 2020/2021 did not increase business values and now that rates are increasing they are not decreasing the value of businesses. Business values did drop after the 2007/2008 recession, but this was a result of decreased earnings, the multiples remained largely the same. Likewise, low interest rates after the COVID pandemic did not increase business values, and the businesses that saw reduced values were the result of reduced earnings, while businesses with strong earnings sold at premiums.

For commercial real estate and investment properties in Southern California prices have continued to increase as a result of high demand and a strong economy in Orange County and Los Angeles.

What is the Effect of Interest Rate Increases on Net Income after debt service?

Let’s look at some hard numbers as an example to illustrate why small changes in the Prime Rate and subsequently the SBA lending rate have a minor affect on business value.

Let’s say Steve Smith is considering buying a business for $1,000,000. For this example we’ll assume the business has Discretionary Earnings (DE) of $350,000 which would put the multiple at 2.85X DE (note this is a typical multiple for this size business depending on the industry).

The maximum SBA rate is Prime Plus 3.0% as of August 2018, so we will use the max rate for these examples (note the max SBA rate was Prime+2.75% prior to 2018). We’ll use the SBA minimum down payment of 10%, or $100,000 for maximum leverage which will show the maximum effect of interest rates.

If Steve was considering buying this business in December of 2022, the Prime Rate was 7.75% and the max SBA rate was 10.75%. The annual debt service would be $163,606 and the net after-debt service would be $186,394. That’s still a nice return on $100,000 down. even with higher interest rates!

Let’s see how that same business acquisition would look in June of 20204 with the Prime rate at 8.5% and the max SBA rate at 11.55%. The annual debt service would be $168,717 – an increase of $5,108 per year, and the net after debt service would be $181,386. Again a very a nice return on just $100,000 down and this deal still makes sense.

| June 2022 | July 2022 | Dec 2022 | July 2023 – June 2024 | |

| Acquisition Price | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 |

| Discretionary Earnings | $350,000 | $350,000 | $350,000 | $350,000 |

| Down Payment $ | $100,000 | $100,000 | $100,000 | $100,000 |

| Down Payment % | 10% | 10% | 10% | 10% |

| $ Financed | $900,000 | $900,000 | $900,000 | $900,000 |

| Prime Rate | 4.75% | 5.5% | 7.5% | 8.5% |

| Max SBA Rate (Prime+3 as of August 2023) Most banks are not charging the max rate. | 7.25% | 8.5% | 10.75% | 11.5% |

| Loan Term | 10 years | 10 years | 10 years | 10 years |

| Annual Debt Service | $140,881 | $148,783 | $163,606 | $168,714 |

| Net After Debt Service | $209,119 | $201,217 | $186,394 | $181,286 |

| Additional Annual Debt Service Cost over June 2022 | $0 | $7,902 | $22,725 | $27,833 |

At Pacific Business Sales we are experts in transactions with SBA financing and most of our transactions use SBA financing. We have excellent relationships with several SBA PLP (Preferred Lender Program) banks and as your Business Broker we will present your business to our preferred SBA lenders to get a preliminary approval (subject to buyer qualifying). If you are a buyer you can be confident that the SBA financing shown in our Confidential Business Review has been reviewed and approved by our SBA lenders.