How will the 2025 economy and interest rates affect small businesses and the M&A market?

2024 Small Business Acquisitions Up over 2023!

Updated March 8th 2025

BizBuySell 2024 Q4 Market Insights Report: Deal-Making Activity Grows 15% over 2023! Manufacturing Values Continue to Increase

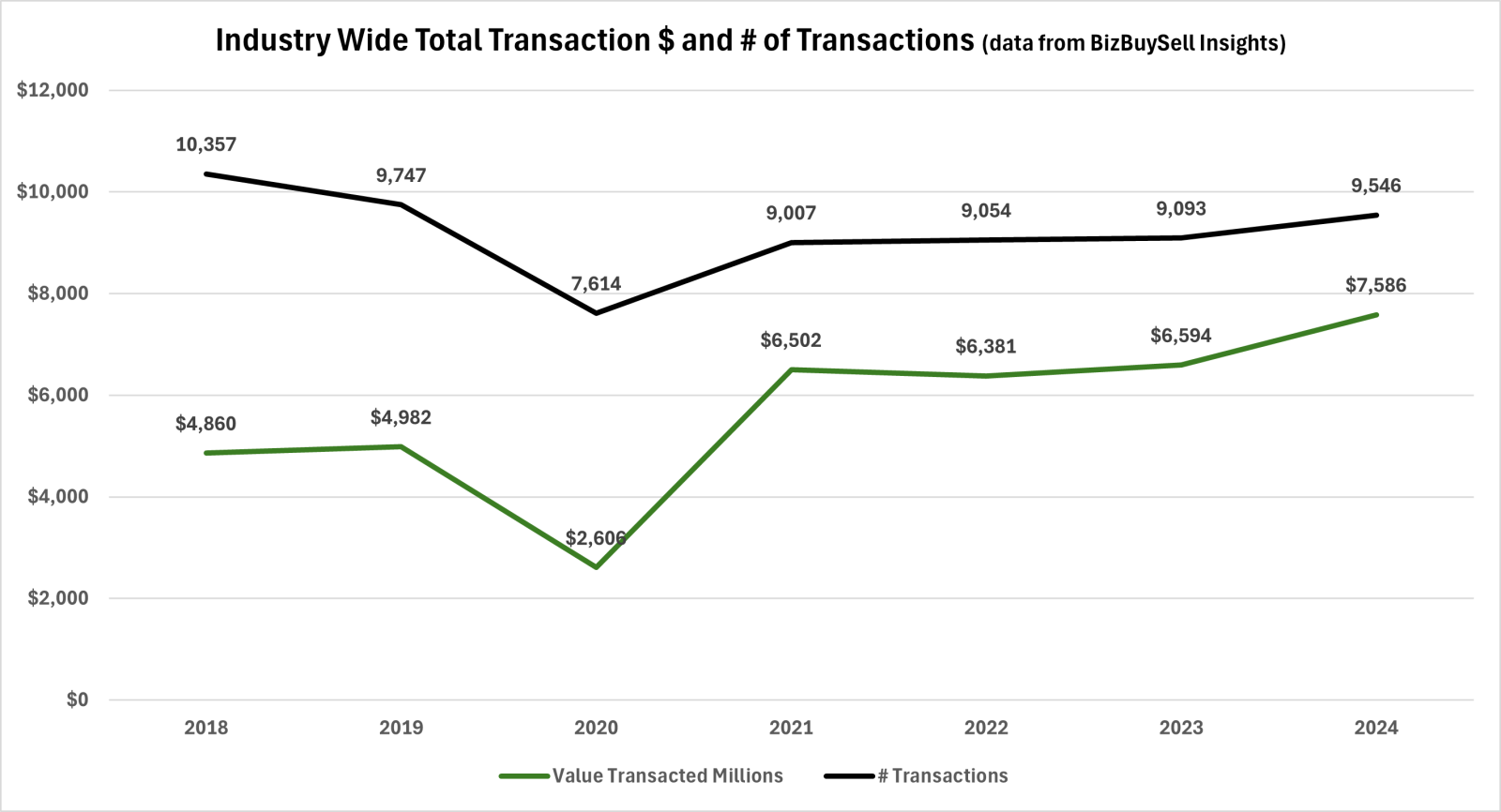

The BizBuySell 2024 Q4 Market Insight report shows that Year-over-Year 2024 transaction values are up 15% from 2023 and the number of transactions in 2024 is up 5% from 2023. Total transactions and values declined in 2018 and 2019, followed by COVID in 2020 which created a sharp drop, followed by a rebound beginning in 2021.

- 2024 small business acquisition values increased 15% over 2023

- 2024 total transactions 5% higher than 2023

- 2024 Q4 total transaction and transaction values were flat with 2023 Q4

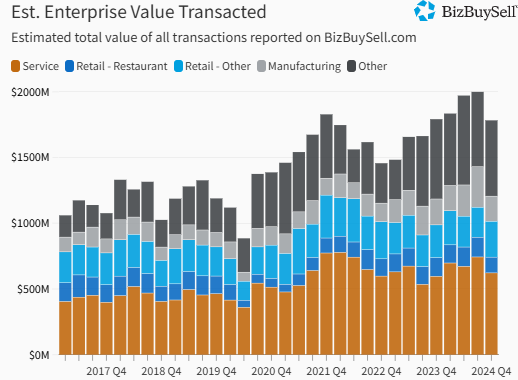

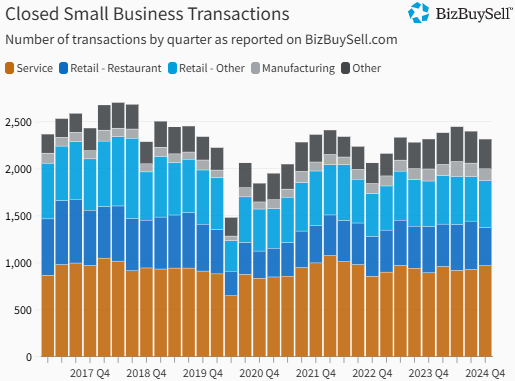

At a glance the BizBuySell Quarterly graphs below for transaction values and number of transactions look like Q4 values and transactions declined, but 2024 Q4 was virtually flat as compared to 2023 Q4 with $1,782 million in Q4 2024 vs $1,791 million in Q4 2023 and 2,315 transaction in Q4 2024 vs 1,791 transaction in Q4 20232. Q4 is historically lower than other quarters, and 2024 overall was up in volume and value.

note: The BizBuySell Insights charts below include data for all transactions, which include a wide variety of businesses ranging from main-street businesses to manufacturing companies.

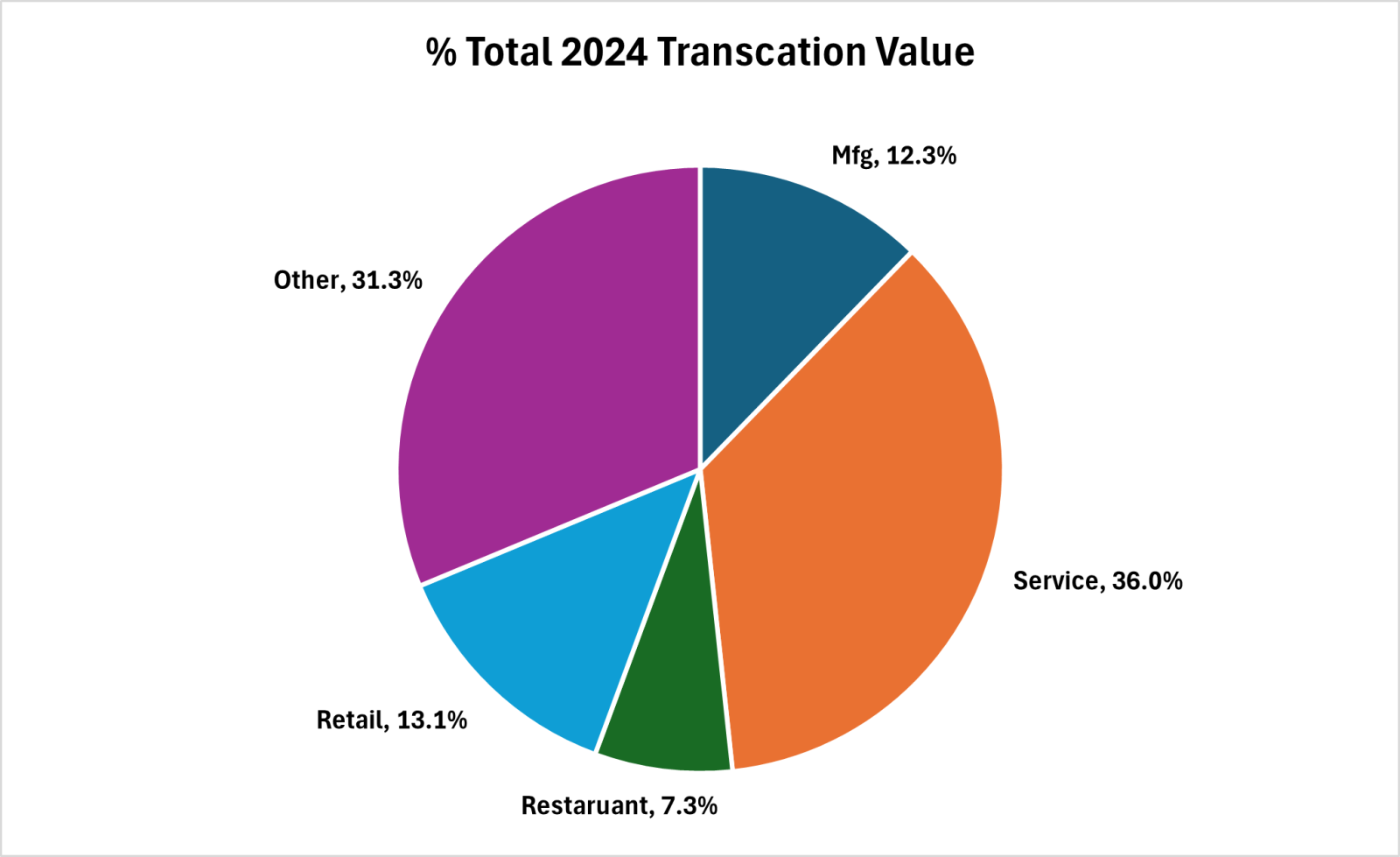

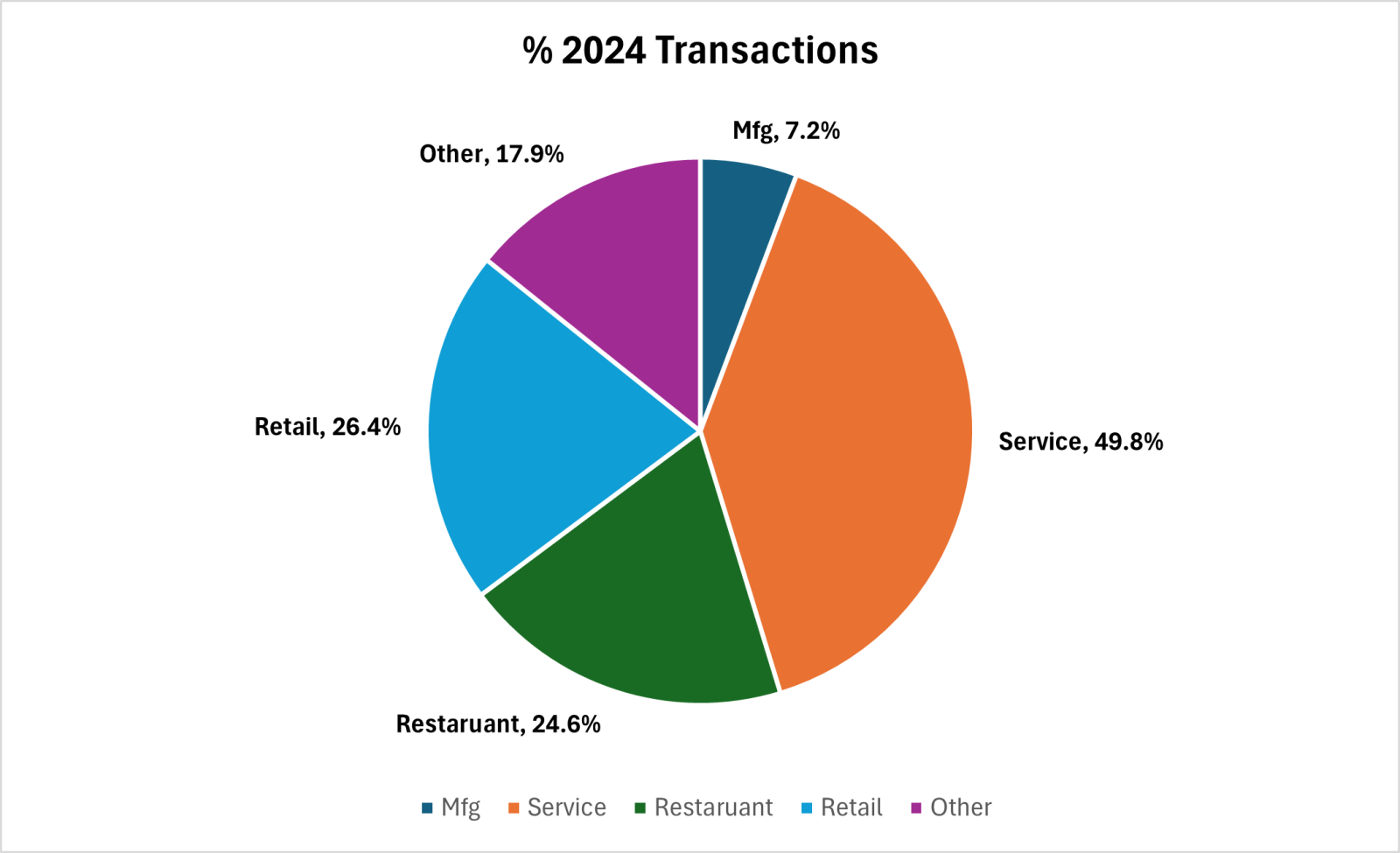

The BizBuySell report data also provides interesting insights into the percentage of small business sales-transactions values and the number of transactions by industry.

For example, Manufacturing is 12.3% of 2024 transaction value and only 7.2% of total transactions, while Retail and Restaurants are 20.4% of 2024 transaction value and 51% of transaction volume.

The explanation is two-fold and straightforward: 1) the population of retail businesses is huge in comparison to the population of manufacturing businesses, and 2) manufacturing businesses tend to have higher revenue and earnings plus sell for higher multiples than retail businesses.

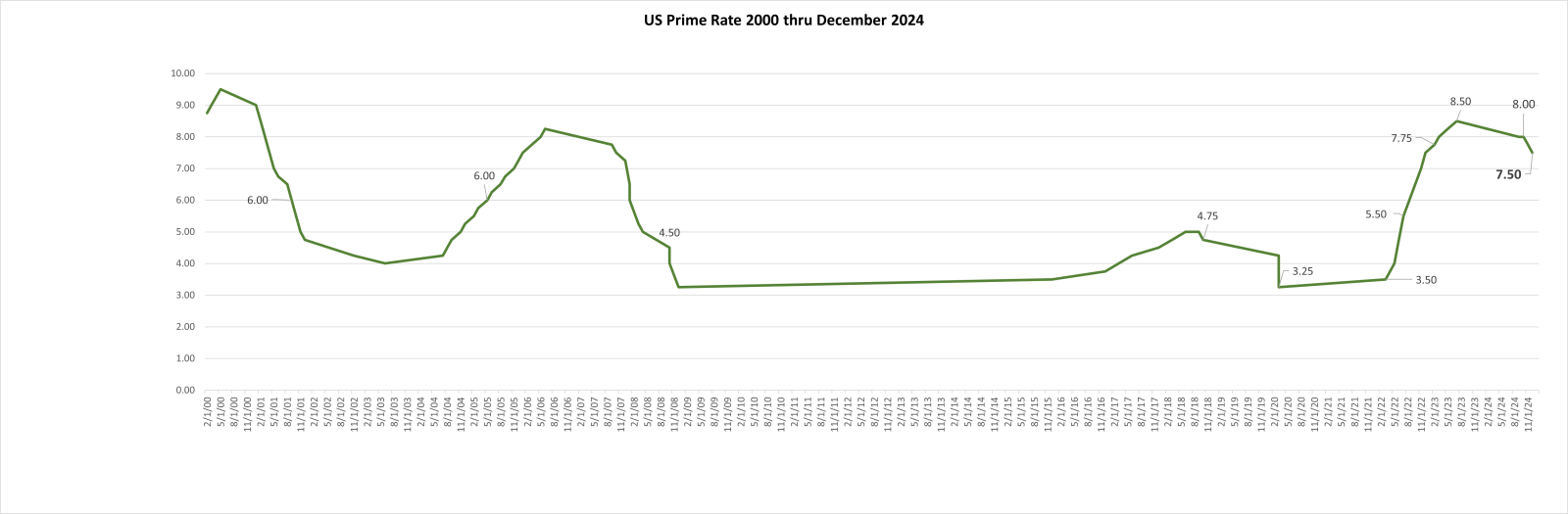

Update on Fed and SBA Interest Rates

Following the January 29th, 2025 Federal Reserve meeting Chairman J Powell announced the Fed Funds rate will remain at 4 1/4% to 4 1/2% for now to ensure inflation continues to move downward toward the target of 2%. At subsequent Fed meetings in February, no changes in monetary policy (interest rates) were discussed, and it seems there will be no further interest rate reductions until inflation figures move downward and concerns about the potential impact of tariffs and federal workforce reductions are alleviated.

During Chariman Powell’s press conference on March 7, 2025 he stated “Despite elevated levels of uncertainty, the US economy continues to be in a good place,” and further rate cuts are on hold until there is greater clarity on the effects of tariffs on the economy.

Read Federal Reserve Official Press Release January 29th, 2025

Read FOMC (Federal Open Market Committee) Summary of Fed Funds Rate Projection

Link to chart showing the Historical US Prime Rate from 1947 to November 2024

Source data for chart above JP Morgan Chase Historical Prime Rate

While the maximum SBA interest rate is now 10.5%, few lenders are charging the maximum rate due to the competitive lending market. We expect most lenders to offer SBA loan rates between 9.75% and 10.25% variable rates over 10 years. We have one lender offering 10-year fixed-rate loans at 8.1% to 8.5% for qualified buyers and businesses. (these rates vary with the current 10-year treasury rate).

2025 US Economy Projections Updated November 2024

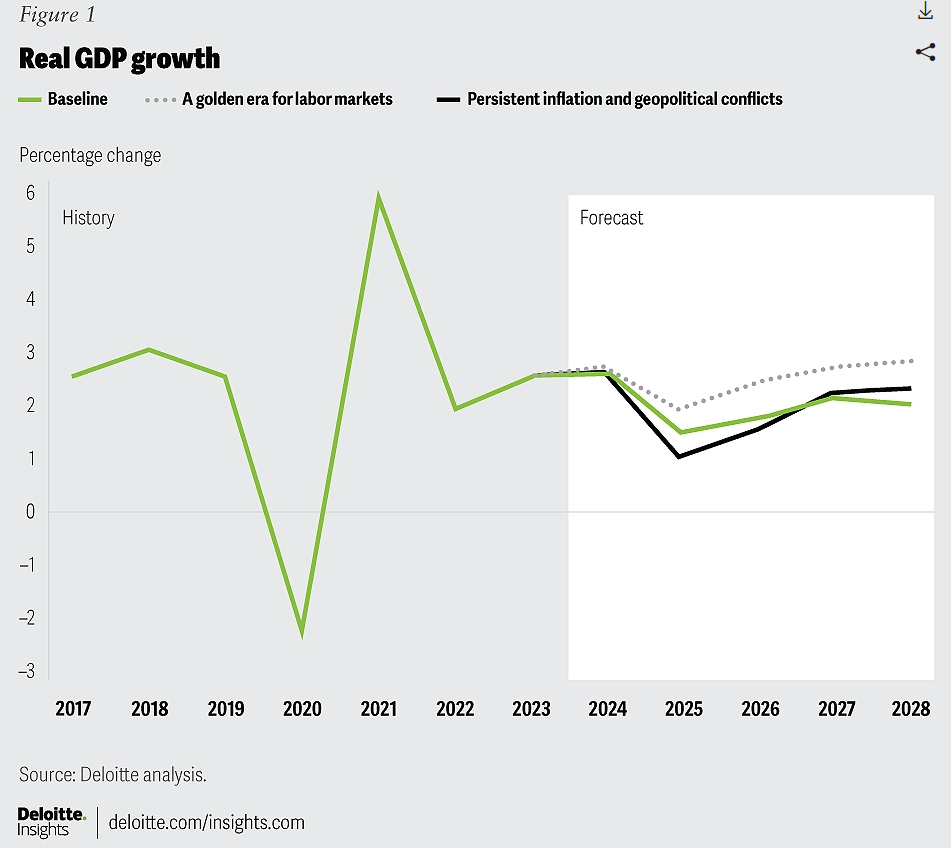

The Deloitte 2024 Q3 Economic Forecast provides excellent insights into the 2025 US economy. Deloitte is projecting slowing, but modest GDP growth in 2025 with increasing GDP growth in 2026 through 2028.

- GDP Growth slowing in 2025, but trending up through 2028

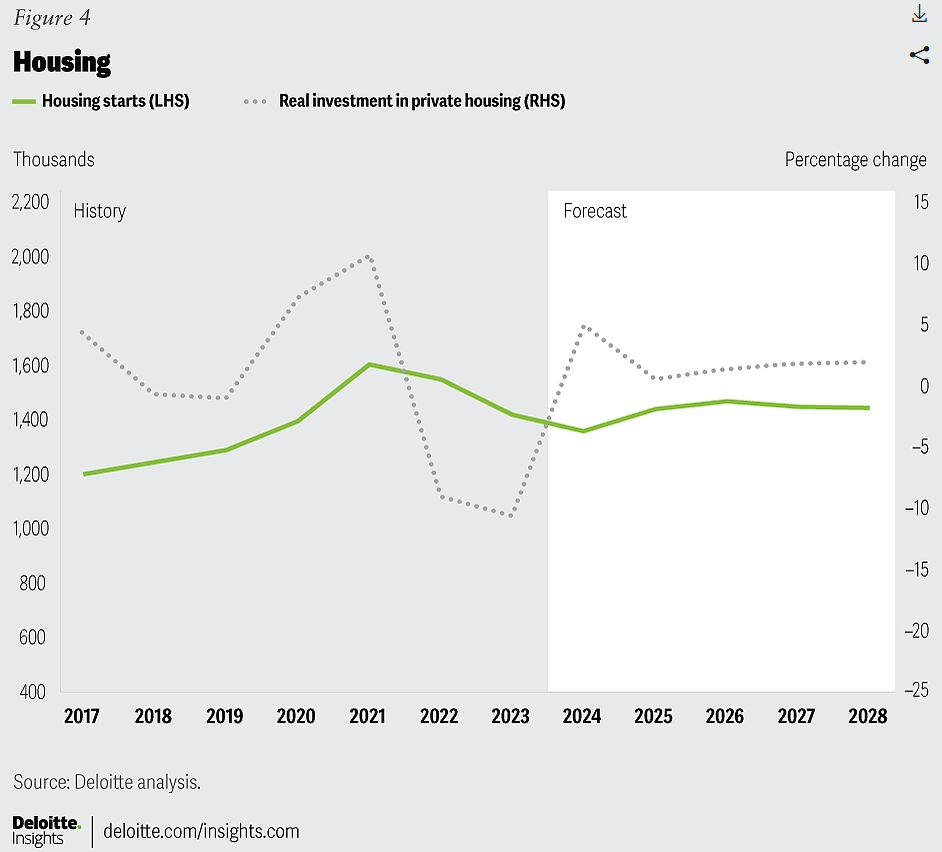

- Housing Starts increasing from the decline in 2021 through 2024, and modest growth in 2025 & 2026

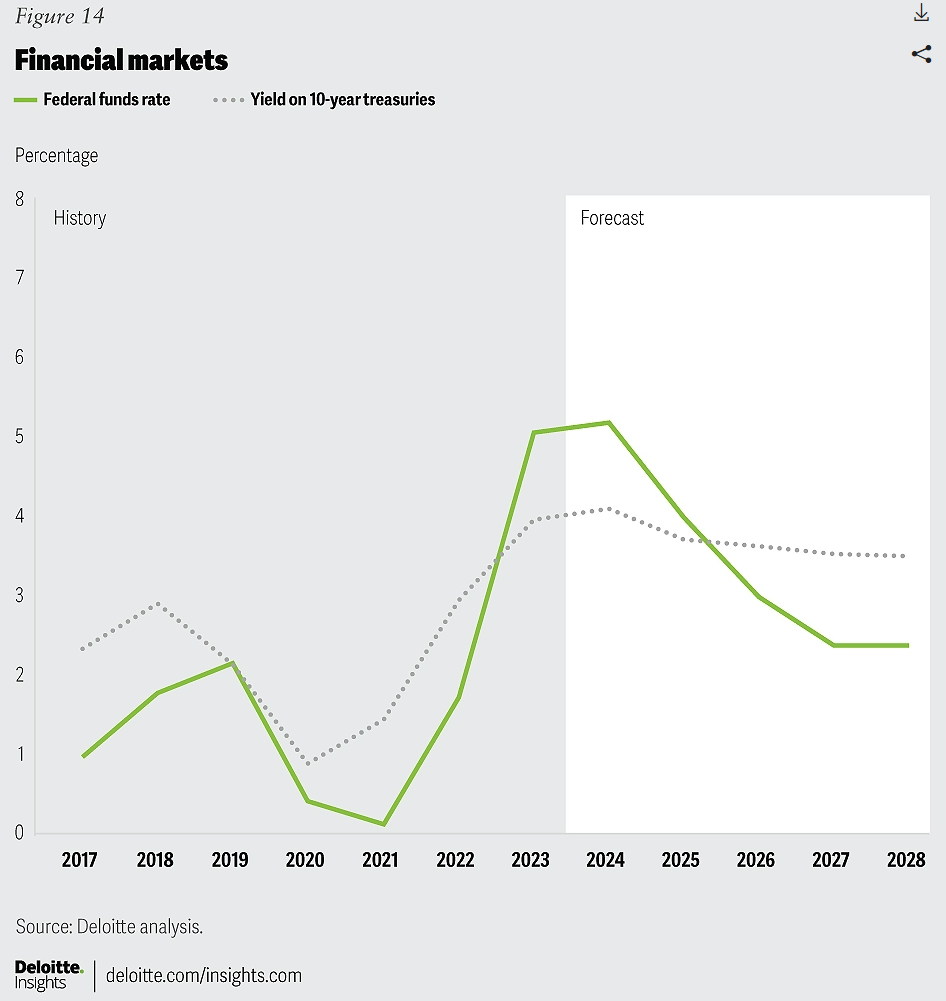

- Fed Funds Rate is projected to continue a downward trend through 2027 and level off

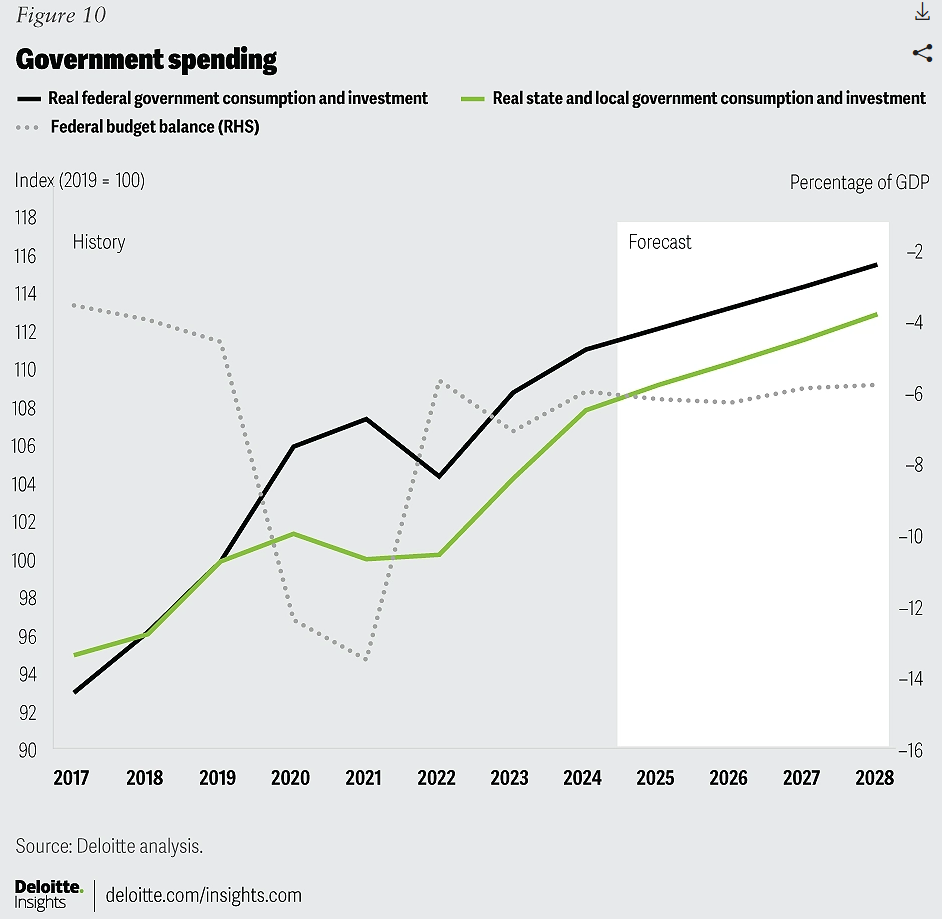

- US Government Spending projected to have steady growth through 2028

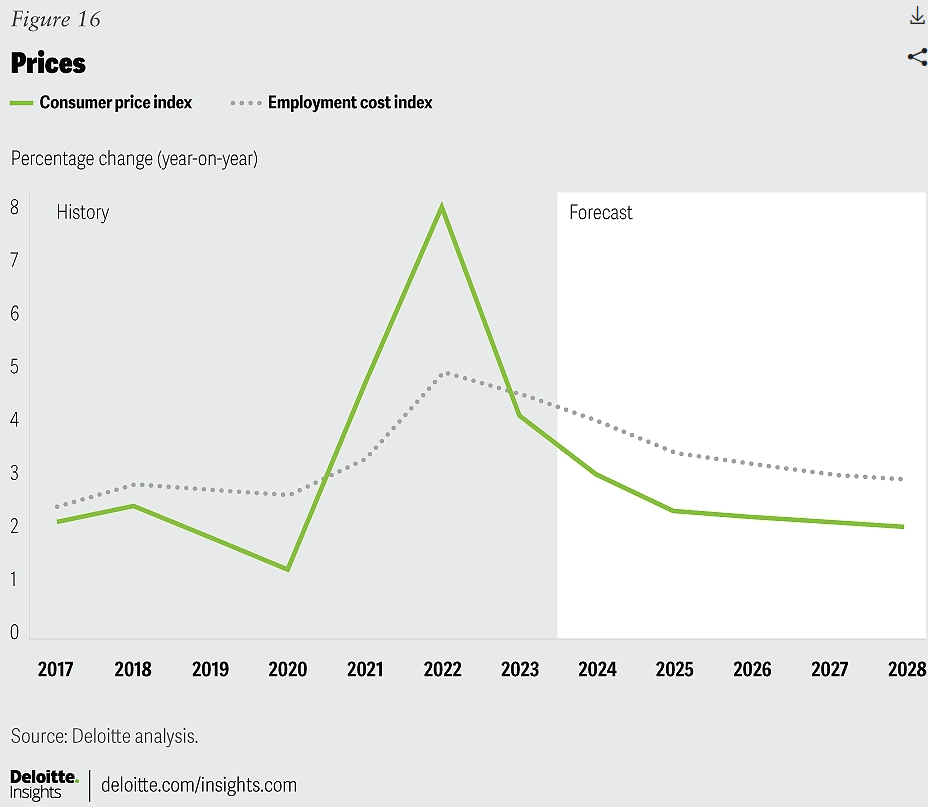

- Consumer Price and Employment Cost indexes are projected to continue to show lower inflation in 2025 leveling off to normal levels in 2026.

Read the full Deloitte 2024 Q3 US Economic Forecast

2025 Housing starts are projected to increase slightly with investment in private housing increasing. It is important to note that Housing Starts reflects single-family home construction and does not reflect multi-unit, commercial, or home remodeling construction. Thus, the chart below only shows new home construction trends.

Deloitte is projecting a steady reduction in the Fed Funds rate through the end of 2026 which will result in further rate decreases in the Prime Rate and consequently SBA loan rates through 2026. This is good new for buyers and business owners with variable-rate SBA loans.

Government spending is projected to increase steadily in 2025 and through 2028 which should be good news for Aerospace and Defense contractors and manufacturing businesses.

Consumer Price and Employment Cost index increases are projected to continue to slow from the 2022 peak through 2025, leveling off to normal inflation rates in 2026 through 2028.

2025 M&A and Small-Midsize Business Sale Outlook

Transaction volume (number of business sales) and transaction values have steadily increased since 2023. With SBA loan rates dropping and overall business financial performance improving, 2025 looks to be a good year for owners wanting to sell their businesses and buyers looking for businesses to buy.

We expect industrial businesses such as B2B services, distribution & 3PL, manufacturing, and construction-contractor businesses to have an excellent 2025 for business sales (transaction) activity and values. Service businesses such as Plumbing, HVAC, and Electrical were in high demand in 2024 and will continue through 2025 as a result of increased acquisition activity by Private Equity.

Retail, restaurants, and hospitality businesses are still recovering and not expected to see significant increases in deal activity or valuations, but they are recovering and on a slow upward trend.

What does all this mean for Small & Mid Size Business Sales & Business Valuations?

Business valuations are driven by earnings, specifically Discretionary Earnings and EBITDA. While business revenues and earnings vary, the multiples of earnings (DE & EBITDA) do not change much. Valuation multiples vary by industry type and business size, but within an industry, they don’t fluctuate much over time or with the economy. Thus your company value is determined by its financial performance, and not Wall Street or even the overall economy.

As an example, during the pandemic retail, hospitality, and travel businesses suffered greatly, while construction, manufacturing, and industrial businesses continued to thrive and business sales in these sectors performed well during and after the COVID pandemic.

Businesses with good financial performance throughout 2023 and 2024 and going into 2025 can expect good valuations and good demand if they go to market in 2025.

Businesses with declining sales and earnings will be difficult to sell and if sold can expect discounted valuations.

While the above is always true, it is especially true now because of the economy, interest rates, and general concerns about companies recovering from the pandemic and economic turmoil of recent years.

Connect With Orange County & California Business Broker Experts

Pacific Business Sales stands as a leading business brokerage firm headquartered in Orange County, serving clients across California with expertise in both asset sales and stock sales, including businesses with licensing. With a dedicated network of financial advisors and other business consultants, we specialize in implementing tax strategies and deal structures aimed at minimizing taxes on business sales. For a consultation or more information on our services, contact us and speak with one of our professionals today.